Financial Aid

Nothing should stop you from pursuing your goals, including financial hardship.

We believe it takes more than a lack of funds to keep a good nurse down, which is why we offer financial assistance to students who would otherwise not be able to afford the cost of attendance.

Your first step in finding out your options is to fill out your Free Application for Federal Student Aid.

Financial Aid Officer

Don’t worry, you’re not alone on this journey. Our Financial Aid Coordinator can help you navigate the financial aid options and pick the solutions that work best for you.

Christian Avila

Financial Aid Office

3301 N. Mulford Road

Rockford, Illinois 61114

EMAIL:

financialaid@sacn.edu

Phone: (815) 282-7900 extension 27613

School Code: 009987

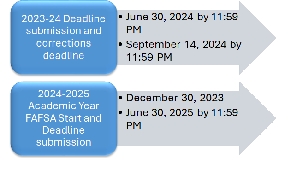

FAFSA Deadlines

FAFSA Deadlines

FAFSA Deadlines

Financial Aid Programs

Saint Anthony College of Nursing is approved by the Illinois State Approving Agency to certify eligible applicants for educational benefits under the Veterans Entitlement Programs: Titles 10 and 38.

To obtain further information about Veteran benefits, student may contact: Christian Avila, Financial Aid Assistant School Certifying Official (SCO) VA Educational Benefits (815) 828-7900, x27613.

- Scholarships

-

We are pleased to be able to offer students the opportunity to apply for several institutional scholarships coordinated by Saint Anthony College of Nursing. We are grateful to all the donors whose generous contributions continue to assist our nursing students fund their education.

For questions about any scholarship, please email us at scholarships@sacn.edu.

SACN Scholarships

- Nursing Legacy Endowment Scholarship

Download a list of Nursing Legacy Endowment Scholarship donors. - Doris & Albert Von Morpurgo Scholarship

Read Doris's story. - Ina M. Cholke & Olga Dean Bullard Scholarship

- Alumni Association Scholarship

External Scholarships

- 25 Helpful Grants for Nursing School

- Abbott and Fenner Scholarship

- American Association of Colleges of Nursing

- B. Davis Scholarship

- Catholic Scholarships

- Central for Rural Health

- Community Foundation of Northern Illinois

- Fastweb

- Health Resources & Service Administration - Nurse Corp Scholarship

- Health Resources & Service Administration - Nurse Corp Loan Repayment

- Johnson and Johnson's Campaign for Nursing's Future

- Nurse Journal Scholarships

- NursingScholarship.us

- Nursing Schools Near Me

- Scholarships.com

- SmartStudent Guide Scholarships

- Veteran's Aid Org Scholarship

- Nursing Legacy Endowment Scholarship

-

Grants

-

Federal Pell Grant

- Does not need to be repaid (unless you withdraw from school and owe a refund)

- Can be used for tuition, fees, living expenses

- This grant is based on financial need

- Amount of award is calculated by the college based on information from the FAFSA

- Awarded to undergraduate students-those who haven't earned a bachelor's or graduate degree

- Amounts can change yearly

- Maximum award for 2024-2025 is $7395

- Does not need to be repaid (unless you withdraw from school and owe a refund)

- This grant is based on financial need

- This need based grant can only be used by Illinois residents attending an approved Illinois school or one of the four military service academies

- Pays tuition and mandatory fees

- Awarded to undergraduate students-those who haven't earned a bachelor's or graduate degree

- Amounts can change yearly

- Estimated maximum award as approved by State Officials

- 2023 - 2024 Rights and Responsiblities

-

Loans

-

There are two types of Federal Stafford loans: subsidized and unsubsidized. The Federal Stafford loans are low-interest loans the student takes out on his/her behalf. To apply online go to Studentloans.gov

Terms and Conditions

Terms and conditions of Federal Student Loans (Direct and Direct PLUS Loans) are listed on the Master Promissory Note signed by a borrower accepting the loan at Studentloans.gov

All Direct Loan information will be submitted to the National Student Loan Data System (NSLDS) and will be accessible to guarantee agencies, lenders, schools and servicers.

Entrance and Exit Counseling

To complete your student loan entrance or exit counseling, please use the following links:

Entrance counseling

Exit CounselingDirect Subsidized Loan (subsidized - need based)

Students may borrow up to $5,500/year, depending on need.

Direct Unsubsidized Loan (unsubsidized - non-need based)

Students may use the unsubsidized loan to reach that portion of the $5,500 that they did not qualify for under the subsidized program. An additional $2,000 unsubsidized may be borrowed by dependent students for a total of $7,500. Independent student may borrow a maximum of $12,500 between the two programs. THE UNSUBSIDIZED PROGRAM REQUIRES THAT THE STUDENT BE RESPONSIBLE FOR THE INTEREST WHILE IN SCHOOL.

Direct PLUS Loans for Parents and Graduate/Professional Students

Parent loans for undergraduate students.

Private/Alternative Loans

These are available to students to help pay the gap in their financial aid. These loans must be repaid, so only borrow what you need.

Historical List that students have previously used include:

FASTChoice-GREATLAKESThe inclusion of a loan product or lender on this site does not imply endorsement. We do not endorse any loan products or lenders. Borrower can choose any lender.

- Entrance Counseling

- Exit Counseling

- Typically have a higher interest rate

- Interest rates/fees based on credit rating

- May require a co-signer

- Not Federally funded

- Cannot be consolidated with Federal Stafford Loans

- U.S. Department of Veterans Affairs

-

Saint Anthony College of Nursing has been approved to provide Veterans Education Benefits by the State Approving Agency for Veterans Education, Illinois Department of Veteran Affairs.

For more information regarding the education benefits, please contact the Financial Aid Office.

- Vet's Gov

- Return of Tuition Assistance Policy

- Illinois AM Vets

- Veteran Aid Org

- ebenefits

- Veterans Crisis Line

- US Department of Veteran Affairs

- Illinois Department of Veteran Affairs

Saint Anthony College of Nursing is approved by the Illinois State Approving Agency to certify eligible applicants for educational benefits under the Veterans Entitlement Programs: Titles 10 and 38.

To obtain further information about Veteran benefits, student may contact:

Christian Avila

Financial Aid Assistant

School Certifying Official (SCO) VA Education BenefitsPhone: (815) 282-7900 extension 27613

Email: financialaid@sacn.eduFor further information please click here to visit the VA office web site.

- Title 10 - Chapter 1606 - Montgomery G.I. Bill® - Selected Reserve

- Title 10 - Chapter 1607 - Reserve Educational Assistance Program (REAP)

- Title 38 - Chapter 30 - Montgomery G.I. Bill® - Active Duty

- Title 38 - Chapter 32 - VEAP - Veterans Educational Assistance Program

- Title 38 - Chapter 33 - Post 9/11 GI Bill®

- Title 38 - Chapter 35 - Dependent's Educational Benefits

Tuition Assistance

The Tuition Assistance (TA) program provides financial assistance for voluntary off-duty education programs in support of a Soldier's professional and personal self-development goals. TA is available for courses that are offered in the classroom or by distance learning and is part of an approved academic degree or certificate program. The courses must be offered by schools that are registered in GoArmyEd, are accredited by accrediting agencies that are recognized by the U.S. Department of Education and are signatories to the current Department of Defense Memorandum of Understanding (DOD MOU).

Tuition assistance details for each service branch

Speak with your ESO or Education Counselor within your military service prior to enrolling with the College of Nursing

How To Use The Military Tuition Assistance Program

Process for Tuition Assistance Benefit

Upload your degree plan to your military branch portal or submit it to your local Base Education Office for approval. When your TA application has been approved and you receive your TA authorization, notify the Financial Aid Coordinator at Saint Anthony College of Nursing. The Coordinator will review your document and confirm the approved courses you have entered. The expected TA amount will be applied as a credit on your account and will reduce the amount of tuition for which you are responsible. The Bursar will generate a voucher to request your TA funds after the institutional refund period.

- Employee Tuition Reimbursement Programs

-

A $300.00 deposit is required, at registration, if you defer any portion of your tuition. If a class(s) is dropped the deferment status may change.

If your employer offers tuition or educational reimbursement, we will defer that amount until the end of the semester, upon employer notification. You will be required to pay the remaining balance above the benefit reimbursement, by the first day of class. The deferred balance will be due, in full, 30 days after grades are posted.

It is the student's responsibility to submit the required documents to their Human Resource Department. The reimbursement benefit is usually paid to the student directly.

Balances not paid within the 30 days will be subject to the 1% monthly interest charge.

- Tuition Waivers

-

Always check with your employer to see what type of tuition reimbursement you and/or your parents may qualify for.

Saint Anthony College of Nursing will disclose the Cohort Default Rate (CDR) in the event the CDR rises above the national average.